DeFi in 2025: The Year TradFi Meets On-Chain Finance

Institutional Adoption, Regulatory Shifts, and the Tech Innovations Reshaping Decentralized Finance

DeFi in 2025 is shaping up to be a year of transformation. What started as a niche experiment for crypto-native users has now evolved into a complex and rapidly expanding financial ecosystem. Institutional players are diving in, regulatory frameworks are taking shape, and technological advancements in scaling and interoperability are making DeFi more efficient and accessible. But beyond the technical improvements, DeFi is also broadening its scope—tokenizing real-world assets, enhancing on-chain derivatives, and even integrating risk management solutions.

This article explores the key trends defining DeFi this year: the growing institutional adoption, shifting regulatory landscape, advancements in Layer-2 scaling and cross-chain interoperability, and the emergence of new use cases. As DeFi continues to mature, it’s not just about yield farming or decentralized lending anymore—it’s about reshaping the future of finance.

Institutional Adoption:

A notable theme in 2025 is the deepening engagement of traditional finance institutions with DeFi. What was once primarily a retail and crypto-native playground is now attracting banks, asset managers, and fintech firms. For example, January 2025 saw the long-awaited approval of the first US spot Bitcoin ETF, which “opened the floodgates for mainstream participation” and set the stage for additional ETFs (Ethereum, etc.) within months.

This, coupled with crypto-friendly signals from the new US administration, has dramatically improved sentiment among institutions. Prominent TradFi players are publicly exploring DeFi: JPMorgan, Goldman Sachs, and BlackRock are actively examining yield farming and decentralized lending services as they look to integrate blockchain-based products. Some large banks have even piloted DeFi transactions – for instance, HSBC and Citi participated in a 2024 experiment using Aave on a private network to settle foreign exchange, and Swift partnered with Chainlink on tokenized asset settlement pilots bridging traditional and decentralized systems.

The motivation for institutions is clear: DeFi’s efficient, automated protocols can offer higher yields and 24/7 liquidity, which appeal to hedge funds, treasuries, and even mutual funds in a low-rate environment. Institutional adoption is also driving product innovation and compliance in DeFi. We see the rise of permissioned DeFi pools (like Aave Arc) where whitelisted institutional players can lend and borrow with KYC/AML checks. Likewise, custody and insurance solutions have expanded so that professional investors feel safer allocating to DeFi. “Institutional DeFi” became a buzzword, indicating hybrid offerings that combine DeFi’s yield opportunities with TradFi-grade risk management.

The influx of institutional capital is expected to bring greater liquidity and stability to DeFi markets, but also an increased focus on regulatory compliance. Indeed, by 2025 regulators themselves are engaging: central banks and agencies are studying DeFi closely, and in some cases even testing it. For example, the European Central Bank and U.S. regulators in late 2024 began drafting guidelines for regulated DeFi applications to ensure that when banks partake in DeFi, they adhere to safeguards. Overall, 2025 marks the beginning of a new era of institutional adoption, with many predicting this year will be remembered for bridging the gap between DeFi and TradFi.

Regulatory Developments:

The regulatory landscape for DeFi is rapidly evolving. In the EU, the landmark Markets in Crypto-Assets (MiCA) regulation came into effect at the start of 2025, introducing a uniform framework across member states. MiCA requires licensing for crypto-asset service providers (CASPs) and imposes certain disclosures and compliance standards. While MiCA largely targets centralized actors (exchanges, stablecoin issuers), its implementation is driving DeFi teams to consider how “truly decentralized” they are and whether they might be captured by future rules.

European regulators (ESMA, EBA) have also discussed DeFi-specific risks – for instance, a joint EU report estimated about 7.2 million DeFi users in the EU (roughly 1.6% of citizens) but noted less than 15% use DeFi regularly. This indicates regulators are gathering data and may craft DeFi policies accordingly.

In the United States, 2024 was marked by aggressive enforcement, but early 2025 has brought a noticeable shift in tone. The SEC, under new leadership, began reassessing its approach: in February 2025 the SEC dropped its high-profile investigation into Uniswap Labs, opting not to pursue enforcement. This followed the SEC also halting or withdrawing actions against other crypto firms, suggesting a potential regulatory thaw. Uniswap’s team heralded the outcome as a “huge win for DeFi,” and it has boosted optimism that regulators might pursue clearer guidance instead of retroactive punishment.

U.S. regulators are also exploring how existing financial laws (like securities and commodities regulations) might apply to DeFi protocols, with industry advocates pushing for new tailored rules in 2025. Around the world, other jurisdictions are crafting DeFi responses: Asia continues to innovate (Singapore and Hong Kong are creating sandboxes for DeFi projects under supervision), while developing countries eye DeFi for financial inclusion but remain wary of risks.

A recurring regulatory focus is on AML/KYC compliance in DeFi. Agencies and bodies like the FATF have highlighted that DeFi applications should not become havens for illicit finance, pressuring countries to enforce the “Travel Rule” and other AML measures on crypto platforms. In practice, this has led some front-end interfaces (for example, certain DEX aggregators) to geo-block or filter users, and it spurred development of decentralized identity solutions for permissioned DeFi.

Tax compliance is another area seeing movement – nations are beginning to issue guidance on how yield farming, staking, and liquidity provision are taxed, which will influence user behavior. The overall trend is that regulatory clarity is slowly improving: Europe’s comprehensive approach, and a possibly more accommodative stance in the U.S., are encouraging for DeFi’s growth. However, projects are still proceeding cautiously, as any new rules on things like DAO liability or protocol registration could significantly alter the DeFi ecosystem.

Layer 2 Scaling and Cross-Chain Interoperability:

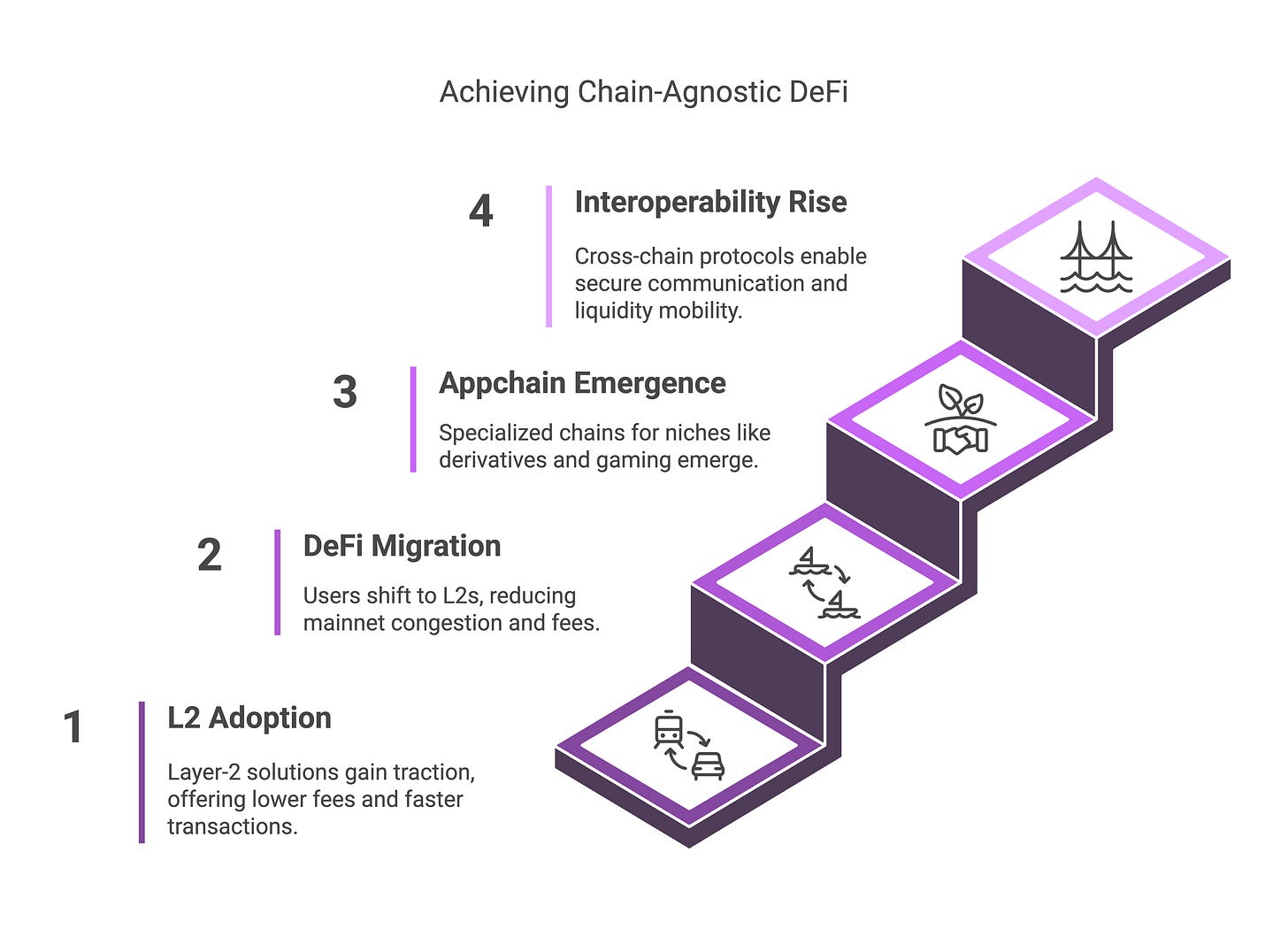

In 2025, using DeFi is becoming chain-agnostic, thanks to major advances in scaling and interoperability. Layer-2 (L2) solutions on Ethereum (such as Arbitrum, Optimism, and zk-Rollups) gained tremendous traction in 2024 and continue to expand. These L2 networks offer dramatically lower fees and faster transaction times while inheriting Ethereum’s security – a perfect recipe for DeFi users priced out of mainnet.

By late 2024, Arbitrum and Optimism collectively held billions in TVL and hosted popular DeFi apps (Uniswap, Aave, GMX) with usage rivaling Ethereum L1. Base, Coinbase’s L2 chain launched in 2023, quickly climbed the ranks as well – capturing ~2.8% of total DeFi TVL within its first months. The net effect is that Ethereum’s throughput bottleneck is easing: gas fees on Ethereum L1 dropped ~98% from their peak as many users shifted routine DeFi activity to L2s or sidechains.

This has made DeFi more accessible (small trades or loans are viable again) and enabled new high-frequency trading strategies on-chain. Looking ahead, specialized appchains and rollups are emerging for specific niches (for example, a dedicated rollup for derivatives trading or gaming assets), further unbundling DeFi activity across chains.

In tandem, cross-chain interoperability has leapt forward, making liquidity far more mobile. Whereas early DeFi users had to manually bridge assets between siloed chains, 2024 saw the rise of generic messaging protocols like LayerZero and IBC. These allow smart contracts on different chains to communicate securely.

Emerging Use Cases in 2025:

The DeFi of 2020 gave us swaps, lending, and yield farming. The DeFi of 2025 is branching into a far wider array of financial services.

One hot arena is Real-World Asset (RWA) tokenization. After rapid growth in 2024, RWA platforms are connecting off-chain assets (like Treasury bills, real estate, invoices) to DeFi liquidity. Protocols such as MakerDAO, Goldfinch, and Centrifuge brought real-world loans and bonds on-chain, offering stable yield backed by traditional assets.

Another burgeoning use case is DeFi for NFTs and gaming assets. Whereas NFTs were once purely speculative collectibles, in 2024 several projects enabled using high-value NFTs as loan collateral. This trend is expected to grow – imagine borrowing stablecoins against a valuable NFT or in-game item instantly, turning illiquid holdings into liquidity.

On-chain derivatives and structured products are also evolving. Beyond the perennial growth of perpetual futures exchanges, 2025 is seeing more user-friendly options, vaults, and automated strategies.

Furthermore, DeFi insurance and risk management products are now a recognized sector. Platforms like Nexus Mutual, InsurAce, and Risk Harbor are providing coverage for smart contract exploits or stablecoin depegging. By 2025, it’s expected that major DeFi platforms will integrate insurance options directly.

Decentralized identity and credit scoring are also emerging use cases, although still early. Projects working on on-chain reputation may enable under-collateralized lending – a development that could bring broader consumer finance use cases into DeFi in coming years.

In summary, DeFi in 2025 is not just about trading and liquidity mining; it’s gradually encompassing functions of traditional finance (asset management, insurance, payments, real-world credit) in a decentralized manner.

Conclusion

The DeFi landscape in 2025 is a far cry from its early days. With institutional adoption accelerating, regulatory clarity improving (albeit slowly), and infrastructure becoming more seamless, DeFi is moving beyond its experimental phase into something more robust and integrated with traditional finance.

Yet, challenges remain. Regulatory uncertainty still looms, security risks persist, and the industry must balance innovation with compliance. But one thing is clear—DeFi is no longer just an alternative financial system; it’s becoming a core pillar of the broader financial world. Whether through permissioned DeFi, real-world asset tokenization, or advanced cross-chain liquidity solutions, the sector is proving its resilience and adaptability.

As we move forward, the big question isn’t whether DeFi will succeed, but how it will continue to evolve. The next frontier is about refining user experience, ensuring sustainable growth, and bridging the final gaps between decentralized and traditional finance.